indirect rollover

There are pros and cons of owning gold. You can learn about the benefits and drawbacks of owning gold and how to invest in this asset. The first important thing to know about gold is that it cannot be used to pay bills, unlike other assets. During times of crisis, these assets tend to plummet. People need cash to cover their bills. Since gold cannot be used to pay bills, it is not a good option for people who are facing economic hardship.

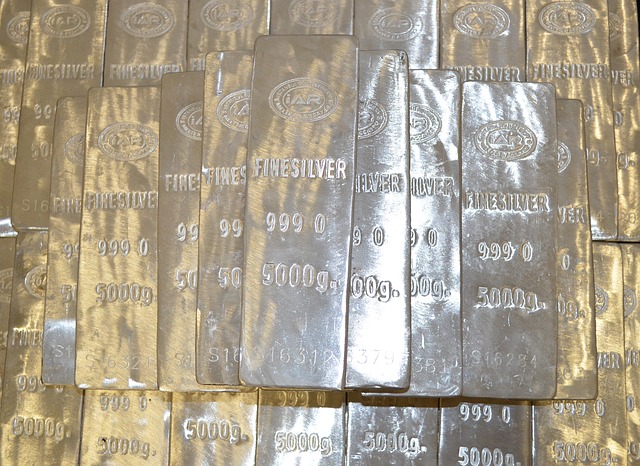

Long-standing staple of human economic life, gold has been the currency of choice. It's more attractive when we are in uncertainty. However, gold investments have not only helped investors make fortunes but also led to significant losses. Before you invest in precious metals, it is essential to conduct financial analysis. Even though gold investment is emotional, financial calculations can help you make a decision. What are the benefits and dangers of gold investment? Here are some tips for investing in Gold.